In the highly anticipated Amazon Q1 2025 financial report, the tech giant unveiled impressive results that exceeded expectations with a net income of $17.1 billion and total revenues of $155.7 billion for the quarter ending March 31. This marks a significant year-over-year growth of 9% and a staggering 64.4% increase in revenue, showcasing the company’s robust performance. Amazon’s CEO, Andy Jassy, highlighted ongoing innovations such as the new Alexa+ and advancements in AWS with Trainium2 chips aimed at enhancing customer experiences. Furthermore, the Amazon earnings report reveals that North America contributed $92.9 billion in revenues, representing nearly 60% of total income. As we delve deeper into the revenue breakdown and AWS growth in 2025, it is evident that Amazon’s strategic focus on innovation is driving its success and reshaping the future of retail and cloud services alike.

The recently released financial statements for Amazon reflect a remarkable beginning to 2025, as the company’s earnings demonstrate strong growth and strategic advancements. The quarter’s results not only highlight revenue increases across various sectors, but also showcase the company’s commitment to innovation, particularly within AWS and its latest product launches. CEO Andy Jassy’s statements emphasize the importance of customer-centric enhancements that are designed to optimize experiences, which are integral to Amazon’s ongoing transformation. With a notable portion of its revenue attributed to North American markets, Amazon reveals a clear picture of its operational health. As we examine the details further, the Q1 2025 financials encapsulate the firm’s forward momentum and provide insights into its future trajectory.

Amazon Q1 2025 Financial Report Overview

In its Q1 2025 financial report, Amazon demonstrated a robust performance with a net income of $17.1 billion alongside revenues of $155.7 billion. This marks a significant year-over-year increase of 9 percent in net income and an impressive 64.4 percent rise in revenues. This strong start to 2025 reflects Amazon’s strategic focus on innovation and customer experience, which has always been a core component of its operations. CEO Andy Jassy highlighted the company’s commitment to accelerating growth through technological advancements and operational efficiency.

Understanding Amazon’s financial health entails looking beyond mere figures. The record revenue reflects both successful product launches and strategic investments in new technologies such as the latest updates in AWS offerings. With substantial growth reported in North America—accounting for $92.9 billion in revenue—Amazon’s operational strategies appear to resonate well with its consumer base, further establishing its stronghold in the eCommerce market.

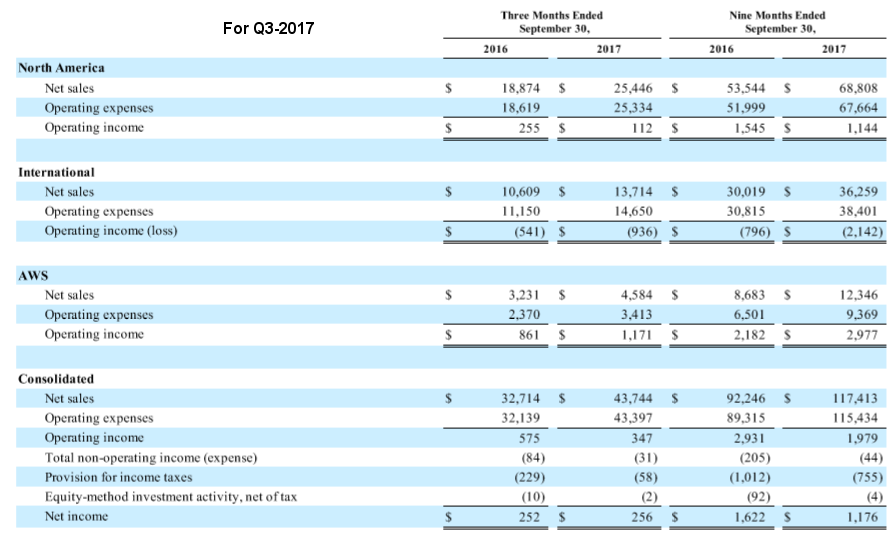

Analysis of Amazon’s Revenue Breakdown

A closer examination of Amazon’s revenue breakdown reveals that North America contributed nearly 60% of total revenues, showcasing enduring consumer trust and purchasing power within the region. With revenues reaching $92.9 billion, which equates to an 8 percent increase year-over-year, it’s evident that local market dynamics are working favorably for the company. This dominating performance in North America reinforces Amazon’s extensive distribution network and customer loyalty programs that help drive sales.

Meanwhile, Amazon’s international revenues also made a notable contribution, with $35.5 billion reported, up by 5 percent year-over-year. While the international market challenges remain, this revenue growth indicates a successful penetration strategy in diverse markets. Additionally, the rise in AWS revenues by 17 percent to $29.3 billion underscores the pivotal role that cloud services play in Amazon’s overall revenue mix, indicating a strong demand for its cloud solutions among global businesses.

Impact of AWS Growth in 2025

Amazon Web Services (AWS) has emerged as a cornerstone of Amazon’s revenue structure, underpinning the company’s tech-forward strategy. In Q1 2025, AWS alone generated $29.3 billion in revenue, reflecting a remarkable growth of 17 percent from the previous year. This growth trajectory illustrates the increasing reliance of firms on cloud technology and the robust demand for flexible and scalable computing solutions. AWS’s expansion is critical not only for Amazon’s financial performance but also for its competitive positioning in the tech landscape.

Moreover, notable partnerships secured with industry giants such as Adobe, Uber, and Cisco demonstrate AWS’s escalating relevance in the business world. As organizations transition to cloud-based infrastructures, AWS is strategically positioned to capture a significant share of this burgeoning market. The ongoing innovation, highlighted by the launch of next-generation tools such as Trainium2 chips and new AI model functionalities, enhances AWS’s attractiveness, further solidifying Amazon’s long-term growth prospects in 2025 and beyond.

Innovation Highlights from Amazon’s Q1 2025

Innovation remains a cornerstone of Amazon’s operational ethos, and this was underscored in the Q1 2025 earnings report. CEO Andy Jassy emphasized transformative advancements such as Alexa+, which promises a more intelligent and responsive user experience. By integrating cutting-edge AI technology, Amazon aims to enhance engagement with its smart devices and ensure that customers benefit from more personalized interactions and automation in their daily routines.

Additionally, the successful launch of Project Kuiper satellites into low earth orbit marks a significant leap towards expanding broadband access to underserved areas. This innovation not only evidences Amazon’s commitment to social responsibility but also opens new market avenues that can generate further revenue streams. As such projects materialize, they not only boost Amazon’s reputation but also secure its position as a champion of connectivity and technological progress.

Amazon’s Future Revenue Projections

Looking ahead, Amazon projects revenues between $159 billion and $164 billion for the upcoming quarter, which would represent a growth of 7 to 11 percent. This optimistic outlook reflects the company’s strategic initiatives and ongoing investments in technology and customer satisfaction. By continuing to innovate and streamline operations, Amazon is positioning itself to not only meet but exceed these expectations, reinforcing its market leadership.

The projected revenue growth is particularly significant considering the competitive landscape of e commerce and technology. Amazon’s ability to anticipate consumer trends and adapt quickly will be essential for maintaining this upward trajectory. As the landscape shifts toward a digital-centric model, Amazon’s investments in advanced technologies should yield dividends, helping to attract new customers and retain existing ones.

Understanding Free Cash Flow Trends

In Q1 2025, Amazon reported a decrease in free cash flow to $25.9 billion, down from $50.1 billion in the same period the previous year. This sharp decline raises questions on operational efficiency and capital allocation. However, it is essential to contextualize this figure within the larger framework of Amazon’s long-term growth strategy. Fluctuations in free cash flow can be expected as the company invests heavily in innovation and expansion efforts that promise greater returns in the future.

Despite the drop, Amazon’s focus remains on bolstering its infrastructure, enhancing customer experience, and expanding product offerings, which in turn are likely to secure future cash flow growth. As new projects, especially in the technology and logistics sectors, come to fruition, it is anticipated that free cash flow will stabilize and improve, reflecting healthier financial metrics in subsequent quarters.

Market Reactions to Amazon’s Q1 2025 Performance

Amazon’s Q1 2025 financial disclosures led to varied market reactions, influenced by both the impressive revenue growth and concerns over declining free cash flow. Investors demonstrated optimism toward the net income figures, reflecting a 9 percent increase year-over-year. However, some analysts raised caution regarding the potential implications of falling free cash flow, reminding market watchers to consider operational scalability and the impact on future investments.

The overall assertion of trust in Amazon’s long-term growth strategy, especially concerning its innovation in e-commerce and cloud services, indicates a resilient market sentiment. With strong performance in AWS and a promising outlook for the upcoming quarters, market analysts remain cautiously optimistic about Amazon’s stock performance. Continued focus on enhancing customer experiences is likely to appease investors, potentially leading to a rebound in stock prices as the effectiveness of these innovations becomes evident.

Strategic Agreements and Partnerships

In this quarter, Amazon underscored the importance of strategic agreements that can boost AWS’s growth trajectory, signing landmark deals with companies such as Adobe, Uber, and Cisco. These partnerships are more than just transactional; they represent a growing ecosystem of collaboration that enhances AWS’s value proposition to users looking for reliable and innovative cloud solutions. With these alliances, Amazon is not only solidifying its position in the cloud market but is also expanding its reach across various economic sectors.

Significantly, these agreements facilitate access to cutting-edge technology and shared intellectual resources that will likely drive further innovation within AWS offerings. By forming strategic alliances, Amazon can leverage complementary strengths to deliver top-tier services to clients, ultimately enhancing user satisfaction and retention. This collaborative approach may prove essential in solidifying AWS’s standing as a leader in the cloud computing landscape.

The Role of Customer Experience in Amazon’s Growth

Amazon’s commitment to improving customer experience remains a driving force behind its growth. With enhancements like faster delivery options and more intelligent automation through devices like Alexa+, the company is continually finding new methods to meet and exceed customer expectations. As Jassy mentioned, this focus on innovation has a ripple effect that not only boosts sales but also builds trust and loyalty among consumers, which is critical for sustained success.

Additionally, customer feedback plays a pivotal role in shaping Amazon’s product enhancements and service offerings. The ability to quickly adapt to market demands not only solidifies Amazon’s competitive advantage but also ensures that its customers remain at the center of its operational strategies. As more consumers turn to online shopping, Amazon’s focus on providing seamless and efficient experiences is likely to drive further growth well into the future.

Frequently Asked Questions

What are the key figures from the Amazon Q1 2025 financial report?

According to the Amazon Q1 2025 financial report, the company recorded a net income of $17.1 billion with revenues reaching $155.7 billion. This marks a year-over-year increase of 9 percent in net income and 64.4 percent in revenue.

How did North America perform in the Q1 2025 financials for Amazon?

In the Q1 2025 financials, North America generated $92.9 billion in revenue, representing an 8 percent growth year-over-year, which accounts for nearly 60 percent of Amazon’s total revenues.

What was the AWS growth in 2025 as reported by Amazon?

Amazon reported AWS revenues of $29.3 billion for Q1 2025, reflecting a 17 percent year-over-year growth, highlighting the continued strength and expansion of its cloud services.

Can you provide details from Amazon’s revenue breakdown in the latest earnings report?

The revenue breakdown in the Amazon earnings report for Q1 2025 indicates that North America contributed $92.9 billion, international revenues were at $35.5 billion (up 5 percent year-over-year), and AWS brought in $29.3 billion, showcasing robust performance across different segments.

What innovations were highlighted in the Amazon Q1 2025 financial report?

The Amazon Q1 2025 financial report emphasized several innovations, including the next generation of Alexa, faster delivery for Prime members, new Trainium2 chips, and the successful launch of Project Kuiper satellites, all aimed at enhancing customer experience.

What is the forecast for Amazon’s revenues in the upcoming quarter?

Looking ahead, Amazon anticipates revenues between $159 billion and $164 billion for the next quarter, indicating projected growth of 7 to 11 percent compared to the previous year.

Why is free cash flow important in analyzing Amazon’s financial health, according to the Q1 2025 report?

In the Q1 2025 report, Amazon noted a decrease in free cash flow to $25.9 billion, down from $50.1 billion the previous year. This metric is crucial as it indicates the company’s ability to generate cash for reinvestment, debt reduction, and shareholder returns.

What notable partnerships or agreements did AWS announce in the Q1 2025 financials?

The Amazon Q1 2025 financials revealed new agreements signed by AWS with major companies including Adobe, Uber, and Nasdaq, signaling continued growth and partnerships to expand its cloud services.

| Key Metric | Q1 2025 Figures | Year-Over-Year Change |

|---|---|---|

| Net Income | $17.1 billion | +9% |

| Total Revenues | $155.7 billion | +64.4% |

| North America Revenues | $92.9 billion | +8% |

| International Revenues | $35.5 billion | +5% |

| AWS Revenues | $29.3 billion | +17% |

| Free Cash Flow | $25.9 billion | -48% |

| Expected Revenues (Next Quarter) | $159 – $164 billion | +7% to +11% |

Summary

The Amazon Q1 2025 financial report reveals a robust performance with net income of $17.1 billion and total revenues reaching $155.7 billion, reflecting substantial year-over-year growth. The company is focusing on innovation and improving customer experiences, with notable advancements in technology and service delivery. As Amazon looks to the future, they are anticipating continued growth, thus reinforcing its commitment to meet the needs of its customers.